Disclosure: Articles may contain affiliate links. As an Amazon Associate, we earn from qualifying purchases (at no additional cost to you). See our full disclosure here.

Last updated on January 31st, 2024 at 02:53 pm

As adults there are MANY conversations that are difficult to have, but one of the most difficult things to think about, let alone talk about–you guessed it–money.

Savings, retirement, 401K, IRA–there’s so much to think about! How do you know which is the right choice, what will grow the biggest, the fastest, or at the right amount? How in the world do you know how much money you’ll need to live on if you don’t even retire for another 30 or 35 years? Or, maybe you’re afraid you’ve already waited too long to start saving.

Do you own your home or rent, want to retire early or keep working part-time as you get older, are you in a lot of debt (or none at all), and how will inflation factor into how much money you’ll need to save? There are so many variables–no wonder it’s confusing!

These are all valid and completely normal questions. We’re all about saving around here, but saving money on groceries, clothes, or other small purchases is something that seems easy to tackle on a quick, short-term basis. Saving for retirement somehow feels SO much bigger and more daunting.

I know we’re all busy with kids and homes and work, but our financial futures are way too important to keep putting off. Whether you like it or not, you will get an abrupt wake-up call, whether it’s your “babies” leaving for college, or when you see that big college tuition bill, or you realize your 401K balance isn’t what you’d like it to be. But, don’t let your future be decided for you, put yourself in charge.

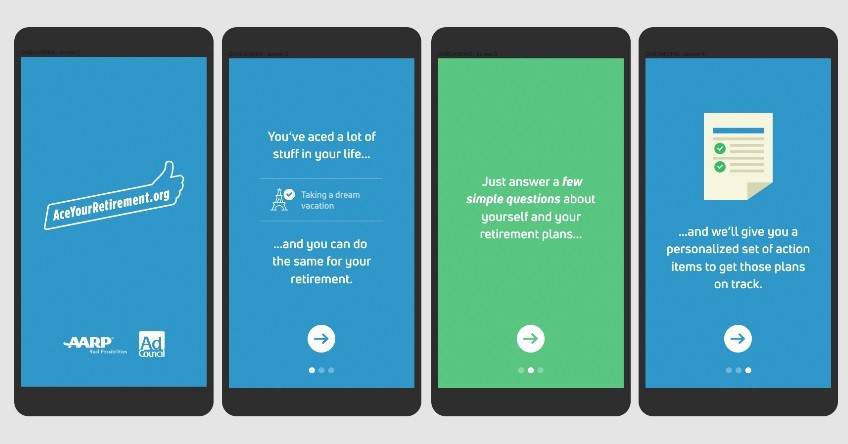

Head over to AceYourRetirement.org to get personalized, simple tips on how to jumpstart your retirement savings and make sure you’re on track.

As you might know, college tuition is going up all the time. My husband and I are trying to save for our retirement, but at the same time, want to contribute to my son’s education so he doesn’t take on too much student loan debt. It was so helpful for me to see a couple of steps I could take today to help make sure my family is on track for a more secure financial future.

Here are a few tips to help you maximize your savings as you plan your retirement.

- While gathered with your family for the holidays, discuss your savings plans and retirement goals, and what you can do today to achieve them. It’s important for everyone in the family to be on the same page about your financial goals and priorities.

- Start planning now at what age you plan to retire and when you plan to start taking your Social Security benefits. Earning a few more years of income could really help you grow your nest egg, and delaying when you start collecting Social Security increases your annual benefit.

- If your employer offers matching funds for your retirement savings plan, make sure you’re contributing at least enough to get the full employer match.

- Brainstorm ideas for earning money in retirement, such as turning a hobby into a source of income, or taking on seasonal part-time work

- Visit AceYourRetirement.org to get your personalized action plan in just three minutes. Your digital retirement coach, Avo℠, will reveal the top three simple, practical things you can do right now to make sure your retirement plan is on track.

Where will you start with your retirement planning? What’s your biggest challenge today? Leave us a comment.

Get Personalized Tips to Plan Your Retirement and Secure Your Future | #personalfinance #retirement Click To Tweet

Also read:

A Beginner’s Guide to Setting Up an Investment Portfolio (6 Important Tips)

You can find MomsWhoSave on Pinterest, Facebook, Instagram, and Twitter. Join us for updates!

Don’t miss a thing! Subscribe to MomsWhoSave’s newsletter.

Leave a Reply