Disclosure: Articles may contain affiliate links. As an Amazon Associate, we earn from qualifying purchases (at no additional cost to you). See our full disclosure here.

Last updated on April 6th, 2023 at 04:43 pm

Annuity vs 401k, retirement accounts…if you’re raising kids, working, and running a household, it might feel like you don’t have time to plan for next week, much less to think about your future financial goals.

Everyone’s days are full, but that said, it’s crucial to start planning for your retirement as soon as possible. The earlier you start, the easier it is to build a nest egg.

And, luckily, with just a few simple tips, you can begin saving for retirement now.

Build Your Retirement Savings With These Tips

-

Start Saving Sooner Rather Than Later

Oftentimes, people save money for retirement by putting their funds in investment accounts like 401(k)s, IRAs, or annuities. For your money to grow, however, these investment vehicles need some time. This is why, the sooner you start investing the better. Whether you start off your investment with $1,000 or $100, what’s most important is that you start as soon as possible.

-

Establish Automatic Savings

When you’re feeling overwhelmed by life, it can easily slip your mind to put money away each month. When you automate your retirement savings, however, the money is saved before you have a chance to spend it or see it in your account. And, that way, you don’t have to endure the mental battle of “letting go” of your money each month either.

-

Evaluate Your Spending Habits

Chances are, you’re spending money on a lot of purchases that you don’t even realize you’re making. Maybe you’re in the habit of buying expensive coffee drinks, giving in to the kids’ when they ask for a toy every time you go shopping, or going out to eat instead of cooking at home.

While it’s okay to enjoy your hard-earned cash, it’s also a good idea to track exactly where your money is going. You might be surprised at how much cutting back on some of these little extras can add up and allow you to save money more money toward retirement.

To see where your money’s going, you’ll want to create a budget so you can better analyze your spending habits. You might categorize your budget to set aside money for entertainment, food, your rent or mortgage, and clothes.

As you create these budget categories, think about where you can cut back on spending and how you’ll pay down debt, so you can redirect funds toward saving for retirement.

Retirement can be one of the most fulfilling times of your life. You get to see your kids all grown up and suddenly have time to focus on yourself. To ensure that you’re properly taken care of, however, it’s important to start saving for retirement today.

Annuity vs 401k

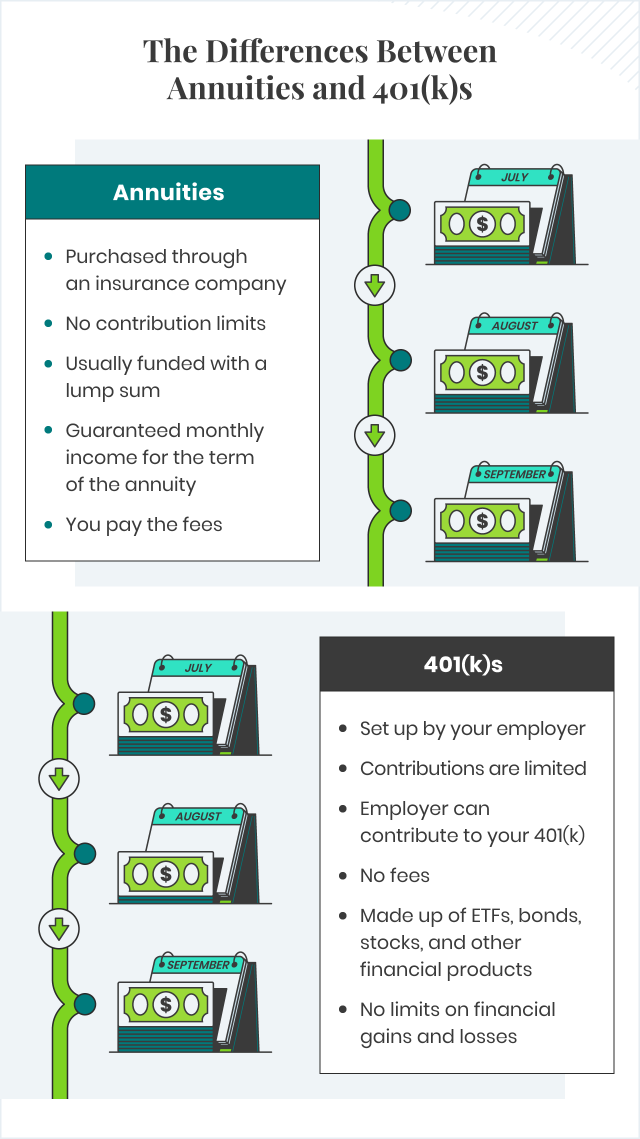

Some of the most common ways to save are by investing in either annuities or 401(k)s. Which of these (or other retirement income options) is right for you will depend on your individual circumstances.

An annuity is a type of insurance product that provides regular payments to the holder for a set period of time or for life. On the other hand, a 401k plan is an employer-sponsored retirement savings account where employees can contribute a portion of their salary on a tax-deferred basis.

Both annuities and 401k plans have their own unique features and benefits, so it’s important to understand how they differ to make an informed decision.

One key difference between annuities and 401k plans is the way they generate income. An annuity provides a guaranteed stream of income that is not affected by market fluctuations. This means that regardless of how the economy is performing, the holder will receive a fixed payment for the duration of the annuity contract.

On the other hand, a 401k plan is invested in a variety of assets, such as stocks and bonds, and the return on investment is subject to market conditions. While this can potentially lead to higher returns, it also means that the value of the account can decrease during market downturns.

Ultimately, the decision between an annuity and a 401k plan will depend on individual circumstances and preferences, such as risk tolerance, retirement goals, and financial needs.

To better understand the difference between these retirement plans, check out the graphic below.

As you begin to put away money for retirement, you’ll want to do plenty of research, and many people opt to work with a financial planner to find the best retirement savings vehicle for their needs.

When did you start to save for retirement? Or, have you started? Do you have a preference when it comes to annuities vs 401ks? Leave us a comment below.

Annuity vs 401k: How They Differ + 3 Tips to Help Build Your Retirement Savings | #personalfinance Click To TweetAlso read:

5 Tips to be Successful in Your First Real Estate Investment

Earn Extra Cash with These Easy Side Jobs: 10 Ideas to Try Now

You can find MomsWhoSave on Facebook, Instagram, Pinterest, and Twitter. Join us for updates!

Don’t miss a thing! Subscribe to MomsWhoSave’s newsletter.

Leave a Reply